An Indepth Forecast Of The Year 2024

Second Quarter Recap

As the second quarter of 2024 concludes, the S&P 500 Index, Dow Jones Industrial Average Index, and NASDAQ Index sit at all-time highs. However, the Russell 2000 Index has remained flat over the past two years. A narrow band of large-cap technology and consumer-based companies has led this stock market rally.

As of June 15, 2024, the S&P 500 Index surged 14.63% year-to-date, while the NASDAQ Index soared 18.26%. These gains stand in stark contrast to the 0.41% decline of small stocks in the Russell 2000 Index.

This market dynamic isn’t new. The FANG stocks (Facebook, Amazon, Netflix, and Google) once dominated, evolving into today’s Magnificent Seven: Microsoft, Amazon, Meta, Apple, Alphabet, Nvidia, and Tesla.

These new market leaders have propelled Large Cap Growth to a 20.06% return, dwarfing Large Cap Value’s 5.44% gain. This Growth vs. Value disparity extends to small caps, with Small Cap Growth up 2.64% and Small Cap Value down 3.44% year-to-date.

Since January, the S&P 500 cap-weighted index has climbed 14.63%, outpacing its equal-weight counterpart’s 4.28% increase. This gap largely stems from the outsized influence of these mega-cap companies.

Year-to-date, all sectors have gained except real estate and consumer discretionary. The technology and communication sectors lead the pack, surging by 18.5% and 16.1% respectively.

In Q2 2024, investors remained optimistic about inflation trends, interest rates, and potential Federal Reserve (Fed) rate cuts. Q1 earnings releases were impressive, with three out of four companies reporting positive surprises averaging 6.8%, almost double the typical 3.3% beat.

Despite talks of lower inflation and a potential economic slowdown, the job market has remained robust. The most recent report showed nonfarm payrolls increasing by 272,000. Over the past year, total nonfarm payroll employment rose from 155.7 million to 158.5 million, showing no signs of weakness. This is crucial as employed individuals continue to drive economic spending.

The healthy job market is reflected in U.S. Gross Domestic Product (GDP), which grew 1.3% over the first quarter, defying earlier recession predictions from 2023.

Fixed income investments held steady in 2024, despite sticky inflation and a strong job market. Shorter-term Treasury notes and bills show positive returns, while the 10-year U.S. Treasury is nearly flat. Only the longest-dated bonds show negative total returns. Corporate bonds follow a similar pattern, with slightly higher returns than Treasury notes. Shorter corporate issues are up for the year, mid-range issues are flat, and only the longest dated are in the red.

As of June 15, 2024, the U.S. Aggregate Bond Index has edged up 0.09% year-to-date. This modest gain comes despite the 10-year U.S. Treasury note yield rising from 3.88% at the end of last year to 4.25% by mid-June 2024.

Economy

The U.S. economy shows mixed signals across various sectors. In the labor market, the jobs report indicates strong nonfarm payroll growth, and rising wages, but also highlights increased unemployment and a shrinking labor force. The housing market struggles with affordability issues, impacting new buyers despite increased construction activity. The manufacturing sector faces contraction due to high costs and reduced demand, while the services sector rebounded strongly after a slight decline the previous quarter. Overall, the economy appears to be in the late phase of the business cycle, with moderating growth, mixed labor market indicators, and easing inflation.

Labor Market

The May jobs report presents a complex picture of the U.S. labor market, showcasing both resilience and potential weaknesses. The establishment survey indicated a robust increase of 272,000 nonfarm payrolls, surpassing all estimates in the Bloomberg economist survey. Gains were led by healthcare, transportation, business services, and leisure and hospitality sectors. Average hourly earnings rose by 0.4%, exceeding most predictions and suggesting continued wage growth despite steady average weekly hours.

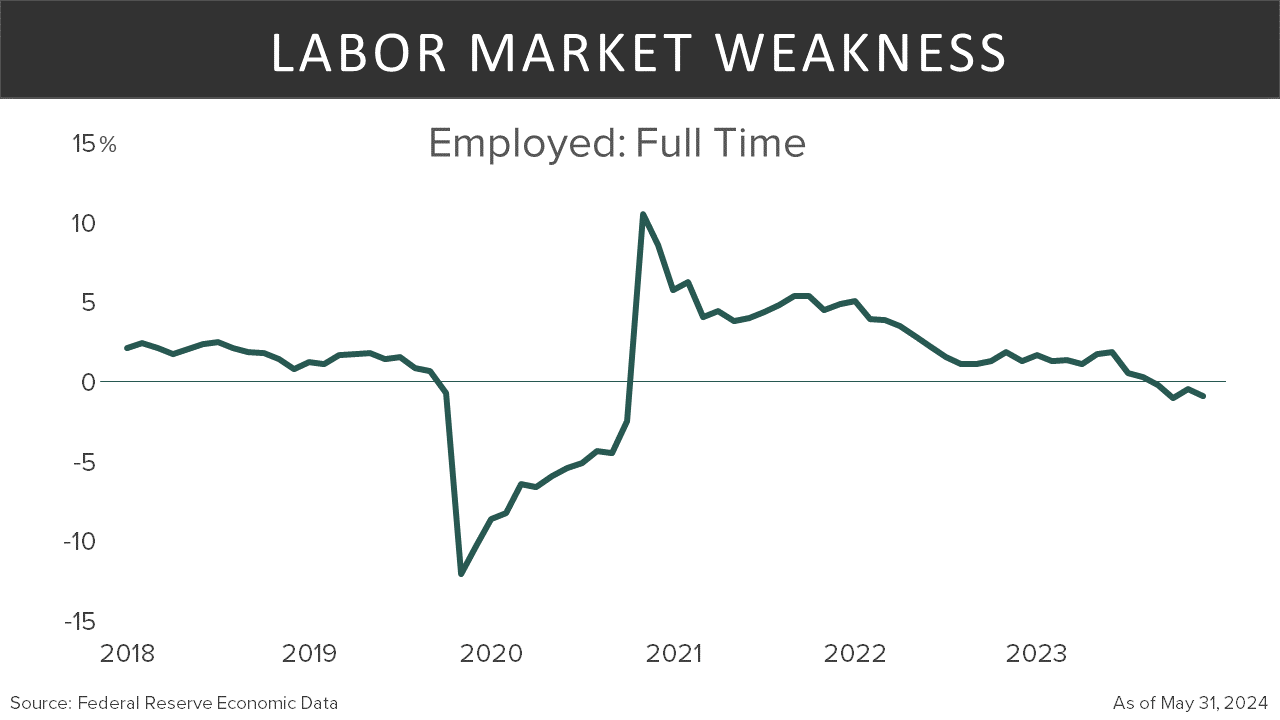

However, the household survey revealed contrasting data, showing a significant contraction and an increase in the unemployment rate to 4.0%. This discrepancy might be attributed to the birth-death model used by the Bureau of Labor Statistics, which may not accurately capture current economic conditions. The household survey also indicated a decline in full-time jobs, an increase in the median duration of unemployment, and a shrinking labor force, with over 400,000 people leaving the workforce in May.

These conflicting indicators are noteworthy. While the strong payroll numbers and wage growth suggest resilience, the rising unemployment rate and shrinking labor force point to underlying weaknesses. The labor force participation rate remains below pre-Covid levels, indicating ongoing challenges.

Given these mixed signals, in June the Fed said to look for only one rate cut this year; having previously suggested three likely cuts. However, with emerging cracks in leading indicators such as claims data, caution is warranted. While negative growth isn’t expected, moderate growth is anticipated in the coming months and quarters.

Housing

Home affordability remains a significant headwind for the housing sector, keeping new buyers on the sidelines due to high prices and mortgage rates. Reluctance to enter the market could prolong the home buyer’s struggles, but single-family home construction, a key driver of aggregates demand is still projected to grow. Reflecting buyer qualms over purchasing a home, multifamily housing starts are expected to rise significantly in the next two years. Despite mixed data on starts and permits, public and private residential construction spending may maintain positive momentum into mid-2024, bolstering the sector’s overall growth.

Consumer/Retail

Solid growth in the first half of 2024 was characterized by a strong consumer base, low unemployment, and progress towards the 2% inflation target. First-quarter GDP grew 1.3%, with second-quarter growth projected at 2.1%. Consumer spending, bolstered by real wage growth, has been a key driver of the current economic expansion. However, recent indicators suggest emerging headwinds.

The latest U.S. retail sales report reveals shifting consumer behavior. Pressured by inflation and higher interest rates, consumers are prioritizing essentials over discretionary spending. Despite this trend, some sectors have shown growth, including motor vehicles, online stores, and sporting goods.

Looking ahead, there are signs inflationary pressures may be easing, which could support moderate growth in the coming quarters.

Sentiment

Consumer confidence improved in May after three months of decline, increasing across all age groups, particularly among the wealthiest and youngest consumers. However, inflation concerns and expectations of rising interest rates tempered this optimism. Average 12-month inflation expectations edged up slightly from 5.3% to 5.4%.

The Conference Board Consumer Confidence Survey highlighted persistent recession fears, with more individuals predicting a downturn within the next year. Despite these concerns, nearly half of consumers expected higher stock prices, indicating continued market optimism. Views on family finances, however, showed slight deterioration.

This survey noted home purchasing plans remained at their lowest since August 2012, while interest in autos and big-ticket appliances saw a modest uptick. Notably, optimism grew regarding short-term business prospects, job opportunities, and income expectations.

Manufacturing vs. Services

The U.S. economy exhibited contrasting trends in its manufacturing and services sectors, according to the latest Institute for Supply Management (ISM) reports. While the services sector rebounded, manufacturing continued to struggle.

The ISM Manufacturing’s Purchasing Managers Index (PMI) registered 48.7 in May, indicating contraction for the second consecutive month and the 18th time in the past 19 months. The New Orders Index fell to 45.4 (values below 50 suggest contraction), signaling reduced future demand. The prices index remained high, indicating ongoing inflationary pressures on raw materials.

In contrast, the services sector saw a strong recovery, with the Services PMI climbing to 53.8 from April’s disappointing 49.4. The New Orders Index also increased, indicating robust demand. However, the ISM report noted challenges persist, with the Employment Index remaining in contraction territory at 47.1. Concerns about high interest rates impacting business growth also lingered.

The ISM report is consistent with the Conference Board survey, noting inflation and interest rate worries continue to affect both manufacturing and services. Manufacturing faces particular headwinds, burdened by high input costs and reduced demand, which may weigh on economic growth in the coming months. The services sector, however, remains strong, buoyed by vigorous business activity and new orders.

Business Cycle

Recent data suggests the U.S. economy remains in the late phase of the business cycle, characterized by moderating growth, mixed labor market signals, and easing inflation. The labor market data discrepancies indicates employment strength might be overstated in some reports, masking underlying weaknesses.

Consumer confidence improved in May, bolstered by a seemingly strong job market. In addition to the persistent inflation concerns and high interest rates, ongoing recession fears remain among consumers, reflecting their cautious outlook.

While we don’t anticipate a recession in the coming quarter, caution is warranted as small cracks like higher-than-expected defaults may develop within the economy. The decelerating growth, mixed labor market signals, and easing inflation, reinforce our view that the U.S. economy remains entrenched in the late phase of the business cycle.

Equity

The main drivers of the current stock market rally are a gentle economic slowdown, moderating inflation, and a cooling labor market. These factors are leading to a potential normalization of Federal Reserve policy, making a soft landing the most likely scenario. A stronger-than-expected earnings season provided a significant tailwind, with 75% of S&P 500 Index companies beating estimates. Additionally, investor enthusiasm for artificial intelligence (AI) – fueled by the belief that AI is ushering in a new technological age – has been sufficient to keep overall stock market averages rising.

Stellar Earnings Season

Equities have rallied in 2024 as S&P 500 earnings recover from the recession that ended in Q2 2023. This downturn, characterized by two consecutive quarters of contracting corporate profits, concluded last fall, largely due to robust earnings from big tech companies. Since then, strengthening quarterly earnings growth has been the primary driver of the rising stock market.

Underscoring the severity of the earnings recession, Bloomberg reports the S&P 500 experienced a significant 25% drawdown during the earnings decline from Q2 2021 to Q2 2023.

However, 2024 saw a turnaround as companies significantly outperformed analysts’ conservative estimates. The January and April reporting seasons showed S&P 500 earnings per share (EPS) growth averaging 8%, far exceeding the 2.5% forecast and marking the strongest two-quarter beat since Q1 2021.

Looking ahead, expectations are rising for future quarters. According to Bloomberg, analysts predict over 8% growth in earnings for the third and fourth quarter, with double-digit gains anticipated to be reported in early 2025. The S&P 500 Index is expected to report the highest year-over-year earnings growth since Q1 2022 at 9.0%, marking the fourth consecutive quarter of positive growth.

For Q2 2024, earnings growth is forecast to be broad-based, with eight of the eleven sectors projected to report year-over-year increases.

Revenue growth has also been robust, with the S&P 500 Index anticipated to report 4.6% year-over-year revenue growth in Q2 2024, marking the 15th consecutive quarter of revenue expansion.

For the full year 2024, analysts project earnings growth of 11.3% and revenue growth of 5.0%. In 2025, earnings are expected to grow by 14.3%, with revenue growth forecast to reach 6.0%.

In summary, the recovery of S&P 500 Index earnings from the recent recession has propelled equities higher, with strengthening quarterly earnings growth and positive revisions to future earnings projections fueling market optimism. The outlook for equities remains bright, with analysts predicting continued robust growth through 2024 and 2025.

Theme Driven Earnings Growth

Theme-driven earnings growth has been a significant factor in the stock market’s performance this year. Companies at the forefront of major trends have seen impressive gains. A major theme is, of course, artificial intelligence. Nvidia, a key player in AI, has seen its stock price soar by 173% year-to-date. Perhaps a surprise to many investors, utilities have also been star performers. Vistra, a utility company providing electricity to power-hungry data centers critical to the AI boom, has soared 128% year-to-date and Constellation Energy surged over 84%.

Another growth theme, obesity, is propping up a segment of the health care sector. Eli Lilly, benefiting from the growing demand for obesity drugs, has risen 51% over the same period.

The “Magnificent Seven,” now represents a staggering 33% of the S&P 500 Index’s market capitalization and has risen by 36% for the same period. These companies, driven by their unique positions in AI, healthcare, and energy, have been the primary drivers behind the earnings recovery in U.S. large-cap stocks.

Nvidia Corp.’s meteoric rise in the AI-driven tech boom has not only propelled it to the top of the corporate world but has also highlighted the immense economic power concentrated in today’s tech giants. To put this in perspective: As of June 17, 2024, Nvidia’s market capitalization of $3.34 trillion now exceeds that of every European stock market. It surpasses the entire stock market capitalization of major economies like the United Kingdom ($3.18 trillion) and France ($3.14 trillion). This semiconductor powerhouse, along with tech behemoths Microsoft ($3.32 trillion) and Apple ($3.29 trillion), each individually outvalues these significant global financial centers.

This comparison starkly illustrates the outsized influence of AI and technology in today’s global economy. Nvidia, Microsoft, and Apple – three companies at the forefront of the AI revolution – now command market caps rivaling or exceeding those of entire developed nations’ stock markets. Their combined value of nearly $10 trillion represents a concentration of wealth and economic power unprecedented in corporate history.

This phenomenon underscores not only the transformative potential of AI technology but also raises important questions about market concentration, economic influence, and the evolving landscape of global finance in the age of technological disruption.

Tale of Two Stock Markets

Earnings remain crucial for large caps’ performance amid policy uncertainty. Large caps, especially in technology, are less sensitive to prolonged high interest rates due to strong balance sheets and ample cash reserves.

In contrast, interest rate uncertainty hampers rate-sensitive sectors like small caps and cyclicals. Smaller companies, with weaker balance sheets, are more vulnerable to high rates. Their debt often has floating rates and shorter maturities, increasing refinancing pressure. Higher rates also dampen investor appetite for riskier assets, including small caps.

Geopolitical Risk

Geopolitical risks and global economic concerns are mounting on several fronts. Election uncertainty, both domestically and internationally, poses significant challenges to market stability. The rising risk of a wider conflict in the Middle East threatens to push oil prices higher, potentially fueling inflation globally.

In Europe, the increasing popularity of far-right parties is causing unease. This shift could lead to changes in green transition policies, tariffs, and fiscal policy discipline, potentially resulting in higher bond yields and slower economic growth. The possibility of a “Frexit” (France exiting the EU) loom as a particularly serious threat to the European bloc’s stability.

These factors may drive global investors away from European equities and towards U.S. markets. However, it’s crucial to remember 41% of S&P 500 revenues and 57% of the technology sector’s revenues come from international markets, highlighting the interconnectedness of global economies.

In the United States, potential leadership changes could have lasting impacts due to differing policies on taxation, energy transition, and tariffs. These shifts could significantly alter the business landscape and affect market dynamics.

Fixed Income

Inflation

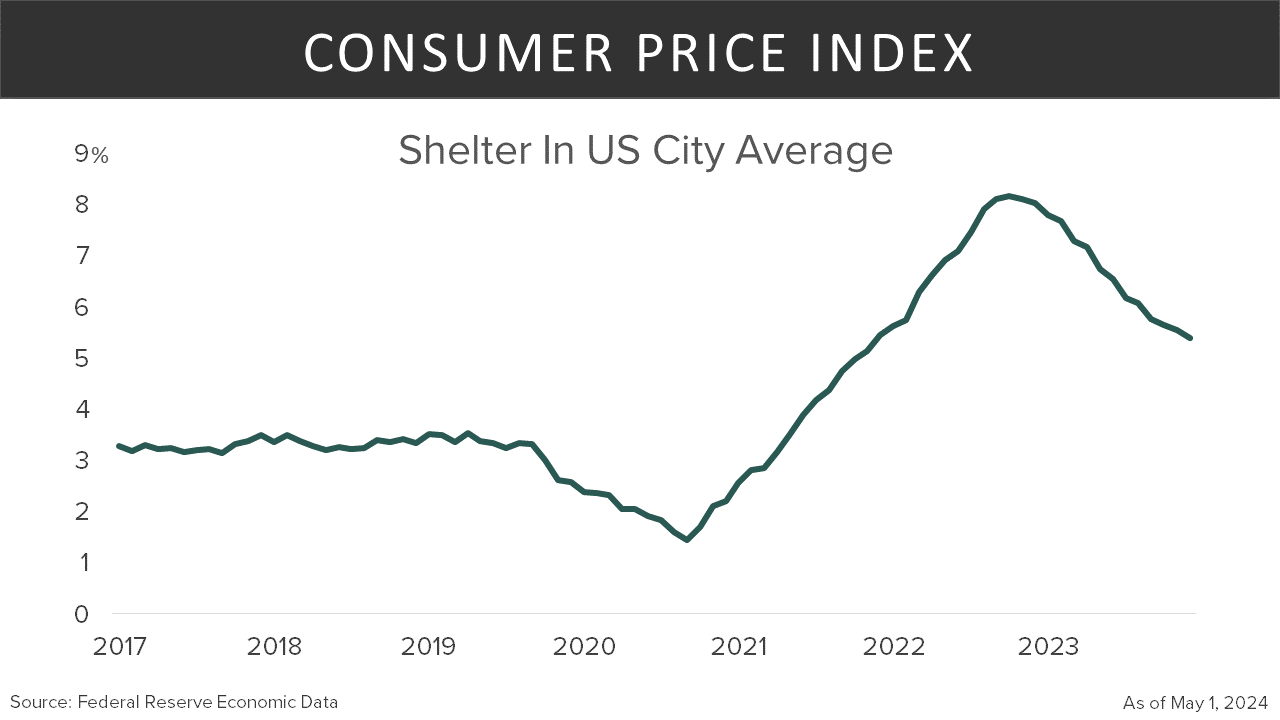

Inflation remains the central topic in discussions about interest rates and fixed income. While the Federal Reserve favors the Personal Consumption Expenditure Price Index (PCE) as the most accurate measure of inflation, the Consumer Price Index (CPI) also provides valuable insights into price trends. The May CPI released June 12 showed promising signs of easing inflation, with both headline and core CPI (excluding food and energy) coming in 10 basis points lower than expected month-over-month. Energy prices, particularly gasoline, were a major contributor to the lower reading, leading to softening in related sectors such as airline fares.

Notably, supercore inflation (core excluding housing) posted its first negative monthly reading since inflation began its meteoric rise in 2021. However, housing/shelter prices, known for their stickiness, increased by 0.4% in May, higher than anticipated. A key takeaway from the recent CPI report was its dip below 3%, moving closer to the Fed’s 2% target rate. This progress has given bond investors hope inflation is subsiding, shifting focus from potential rate hikes to potential cuts. Despite the ongoing deceleration in inflation, policymakers stress the need for several more months of receding price pressures before considering interest rate reductions. The June 7 strong jobs report remains a factor in their cautious approach.

Fed Dual Mandate: Inflation & Employment

The Federal Reserve continues to operate under its dual mandate of price stability and maximum employment. Recent strong economic readings prompted a shift in the Federal Open Market Committee’s (FOMC) internal rate projections, as reflected in the latest dot plot. The median official now expects one quarter-point cut in 2024, two fewer than projected in March’s quarterly forecasts. Conversely, the median forecast for 2025 has risen to 4.1% from 3.9%, implying four cuts instead of the previously projected three. Essentially, one cut has been pushed back a year, while another has been eliminated altogether.

Interestingly, during his press conference, Fed Chair Jerome Powell seemed to downplay the significance of the dot plot. He emphasized the high degree of uncertainty surrounding these projections, noting all committee members’ individual forecasts were plausible and any future moves would depend on incoming data.

As the November Presidential Election approaches, there appears to be a noticeable divergence between the Fed’s statements and the market’s reaction to them. This disconnect underscores the intricate relationship among monetary policy, economic indicators, and market expectations regarding them.

Are Rate Cuts Priced In?

Markets often move in anticipation of future economic conditions, with bonds typically rallying and stocks falling months before a recession hits. Recently, bonds have shown modest strength adjusting to this new outlook for Fed rate cuts. Currently, the 10-Year U.S. Treasury yield reflects investor expectations of potential cuts in 2025. Currently hovering around 4.25%, the 10-Year yield contrasts with Fed Fund futures prices, which indicate two to three rate cuts for 2024.

Crucial to bond pricing is how U.S. bonds compare globally. U.S. Treasuries maintain an appealing yield advantage over their counterparts in Germany, France, the U.K., and especially Japan. This yield premium, combined with the perceived safety of U.S. government debt, makes U.S. bonds an attractive investment option even as the Fed hesitates.

Recent strength in the bond market has somewhat reduced their upside price potential, barring some catastrophe. However, they still offer a solid return if held to maturity, even in the absence of rate cuts.

Our focus should extend beyond the Federal Reserve to encompass the overall strength of the U.S. economy. If signs of economic weakness emerge or job cuts begin to materialize, bonds would likely become even more attractive. While we don’t anticipate such developments in the coming quarter, we recognize economic cycles inevitably bring these phases.

Conclusion

As the second quarter of 2024 concludes, the U.S. stock market presents a tale of two markets: large-cap indices (S&P 500, Dow Jones, and NASDAQ) have reached all-time highs, driven by a narrow band of tech and consumer-based companies, while the Russell 2000 has remained flat for two years. This disparity is evident in the year-to-date performance, with the S&P 500 Index up 14.63% and NASDAQ Index up 18.26%, contrasting sharply with the 0.41% loss in the Russell 2000 Index, highlighting the dominance of large-cap growth stocks, particularly in the tech sector, over small-cap and value stocks.

The U.S. economy shows mixed signals across different sectors, with a strong services sector contrasting with a struggling manufacturing sector, and conflicting labor market indicators from establishment and household surveys. While consumer confidence has improved and overall economic growth remains solid, persistent concerns about inflation, interest rates, and recession fears, along with shifting consumer behavior and housing affordability issues, suggest the economy may be in the late phase of the business cycle, warranting caution in the coming months.

The U.S. stock market has reached new highs despite the Federal Reserve’s conservative approach to rate cuts, driven by a strong earnings season, moderating inflation, and enthusiasm for artificial intelligence. The S&P 500 and NASDAQ indexes have recorded seven positive weeks out of the past eight, with earnings growth far exceeding forecasts and companies like Nvidia, part of the “Magnificent Seven,” seeing extraordinary gains. This market rally is underpinned by expectations of a soft economic landing, continuing robust corporate profits, and the transformative potential of AI technology.

The market also contends with significant geopolitical risks, including Middle East tensions, political shifts in Europe, and upcoming elections in the U.S. These factors, combined with the interconnectedness of global economies, create a complex landscape where market dynamics could be significantly altered by policy changes, international conflicts, or shifts in global investor sentiment.

The U.S. economy is presenting a complex picture, with inflation showing signs of easing but still remaining above the Federal Reserve’s 2% target. The recent more benign inflation reports encourage bond investors. The labor market continues to demonstrate resilience with robust job growth and wage increases despite currently high interest rates. This economic landscape has led the Federal Reserve to adjust its monetary policy outlook, now projecting fewer rate cuts in 2024 than previously anticipated.

The Fed’s shift in stance has created a noticeable divergence between market expectations and the central bank’s statements. While the Fed now favors just one rate cut in 2024, market pricing still reflects expectations of multiple cuts. This disconnect highlights the intricate relationship between monetary policy, economic indicators, and market sentiment. Meanwhile, U.S. Treasury bonds maintain their appeal in the global market due to their yield advantage over counterparts in other developed economies and their perceived safety. As the economy navigates this uncertain terrain, investors and policymakers alike are closely monitoring for signs of potential weakness that could further influence monetary policy and market dynamics.

For Investors:

Equities

- Anticipate Increased Volatility Due to Election Uncertainties in the U.S. and Globally

- Expect Above-Average Earnings Growth

- Prioritize U.S. Equity Over International Markets

- Favor Healthcare, Energy, and Consumer Staples Sectors

- Consider Adding to Positions in Theme-Driven Earnings Growth (AI and Obesity) During Market Pullbacks

- Selectively Add Small-Cap Stocks When the Fed Shifts Policy

Fixed Income

- Prefer U.S. Treasury Bonds

- Bonds May Offer Diversification Benefits: 60/40 Portfolio Mix is Relevant Again After the 2022 Bond Debacle

- Labor Market Conditions May Have a Greater Influence on Fed Policy Than Inflation

- Favor Long-Dated Bonds if Labor Market Conditions Deteriorate Further

What Could Go Wrong?

- Fed Lowering Rates Sooner Than Anticipated

- European Elections Increasing Fragmentation Within the Euro Bloc

- Escalation of Regional Conflicts in the Middle East

- Further Deterioration in U.S. Consumer Spending

- Significant Slowdown in U.S. Economic Growth

Disclosure

This information is of a general nature and does not constitute financial advice. It does not take into account your individual financial situation, objectives or needs, and should not be relied upon as a substitute for financial or other professional advice to assess, among other things, whether any such information is appropriate for you and/or applicable to your particular circumstances. In addition, this does not constitute an offer to sell, or the solicitation of an offer to buy, any financial product, service or program. The information contained herein is based on public information we believe to be reliable, but its accuracy is not guaranteed.

Investing involves risks, including loss of principal.

Past performance is no guarantee of future results.

Definitions

Growth: A company stock that tends to increase in capital value rather than yield high income.

Value: A value stock is a security trading at a lower price than what the company’s performance may otherwise indicate.

Federal (FED) Funds Rate: The target interest rate set by the Federal Open Market Committee (FOMC) at which commercial banks borrow and lend their excess reserves to each other overnight.

*Consumer Price Index (CPI): An index of the variation in prices paid by typical consumers for retail goods and other items.

*U.S. Aggregate Bond Index: Designed to measure the performance of publicly issued US dollar denominated investment-grade debt.

*S&P 500 Index: S&P (Standard & Poor’s) 500 Index: is a market-capitalization-weighted index of the 500 largest US publicly traded companies.

*Dow Jones Industrial Average (DJIA): is a price-weighted index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange and the Nasdaq.

*NASDAQ: is a global electronic marketplace for buying and selling securities.

*Russell 2000 Index: a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index.

*Indexes are not managed. One cannot invest directly in an index.